CREDIT DO

CreditDo, 2015 • 3 Months • Team: Isaac Nwokocha, Shailesh Taniwala, Chris Walker

How might we create financial empowerment for economically challenged middle and high school children living in urban America, through a kinaesthetic experience that helps them visualise their financial future?

"The ChangeLabs team left no stone unturned. From the diverse set of interviews, to the various means of refining the suggested platform and the scaling approach, we couldn't be more pleased with their recommendations."

— Chris Avila Hübschmann, Founder & CEO, Credit Do

The Background

__

The average 2013 U.S. undergraduate student finished school with a combined debt of $35,200 in both school loan and credit card debt. The fastest growing population falling into poverty in the U.S. are children, over 26 million. Credit companies trap young people into spending behaviors and credit loops that they find difficult to escape.

The Systems Design Approach

__

With Stanford Change Labs and the systems design approach we created a scaled, human-centered intervention to revise Credit Do’s (a NYC based non-profit) approach in order to disrupts predatory credit card cycles and creates financially responsible behavioral habits in middle and high school students.

Research

__

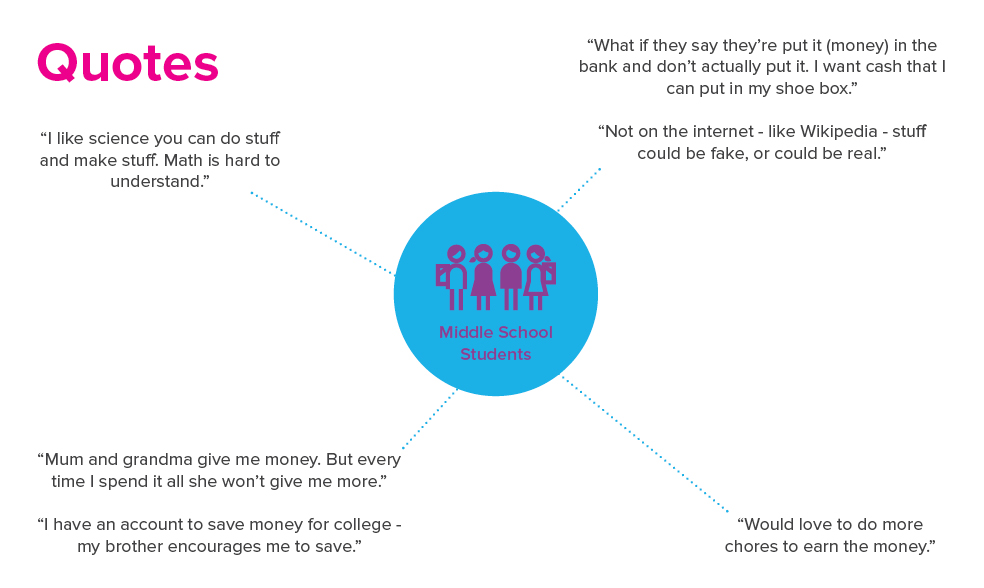

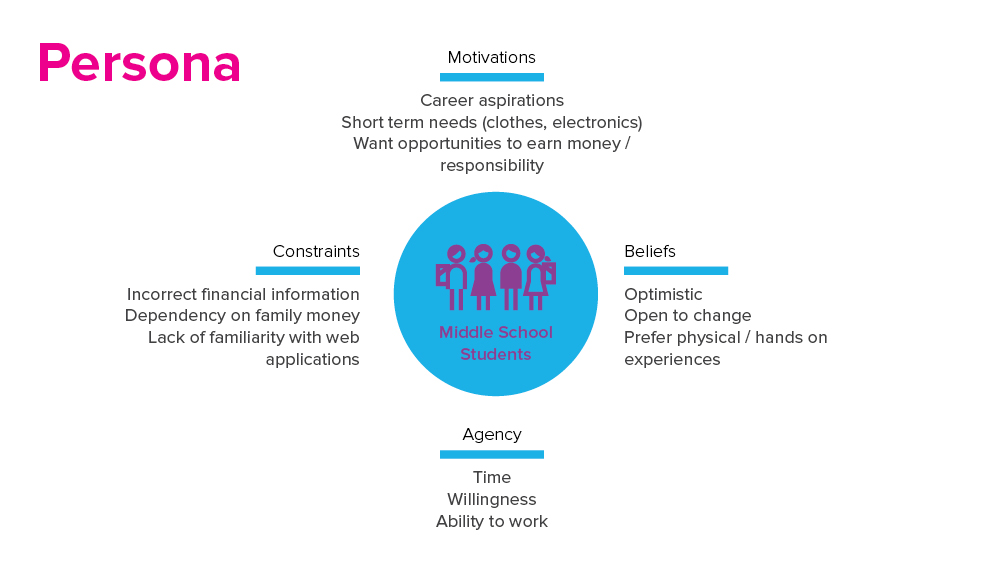

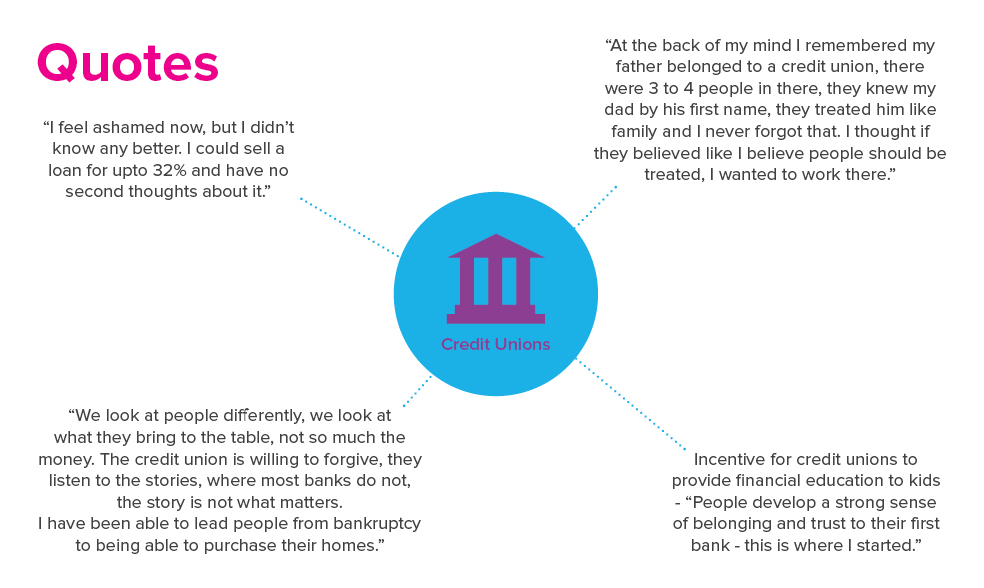

With what we heard during interviews with the different stakeholders of the system, we were able to create a user persona, that captured their motivations, beliefs, constrains and agency. With these personas were were able to understand the relationships and power dynamics between every stakeholder.

Scaling Opportunities

__

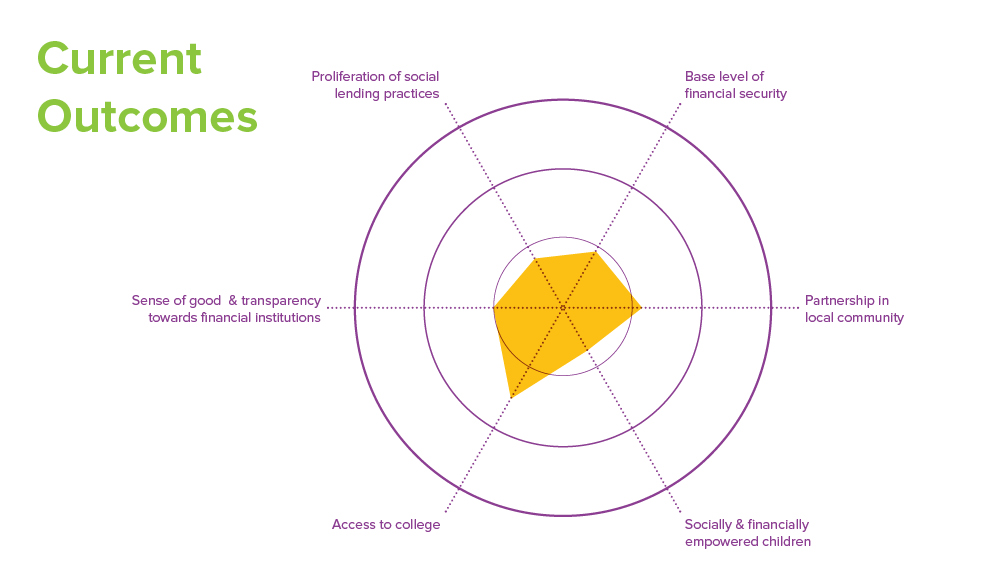

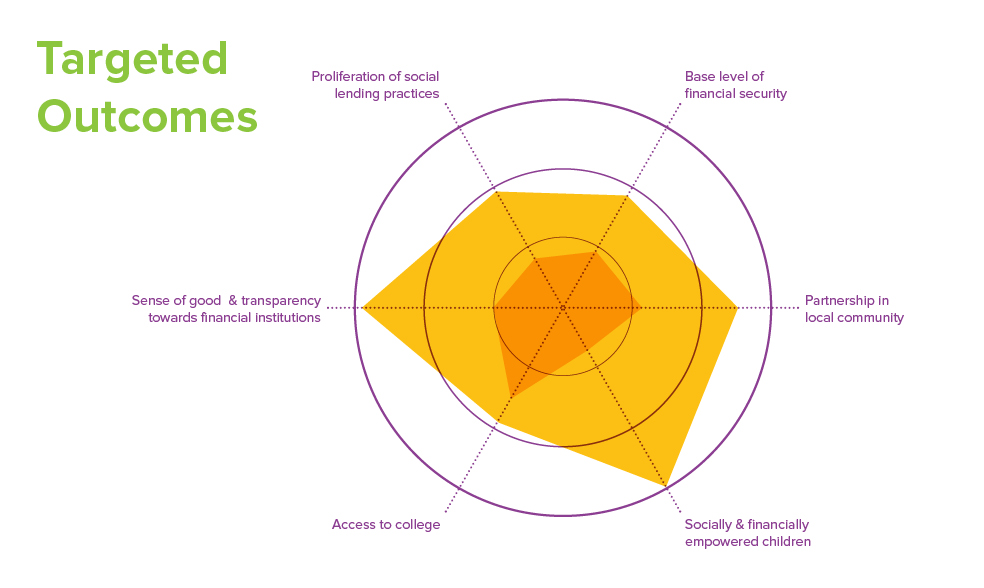

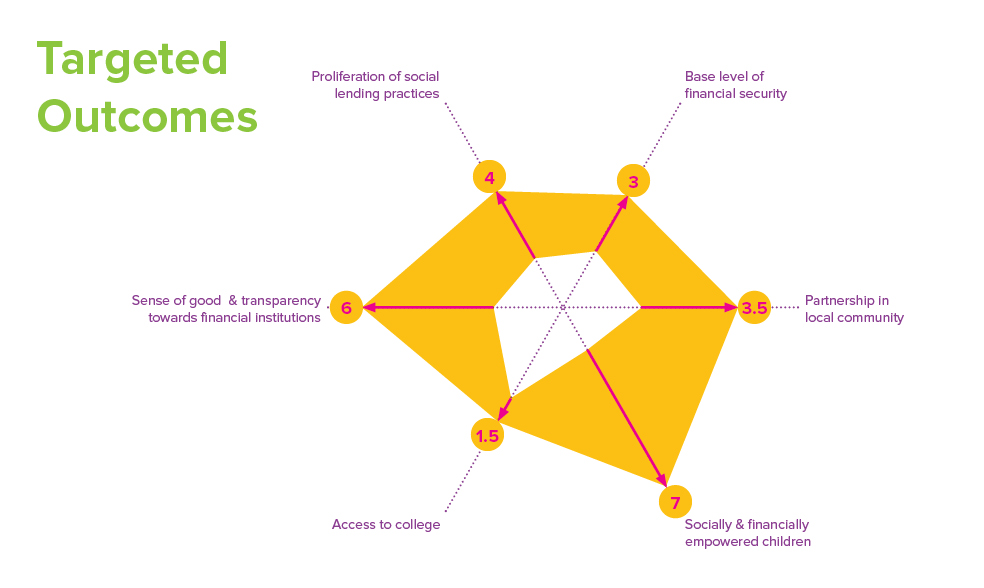

By mapping the current outcomes against the expected outcomes, we were able to identify gaps in the system. These gaps helped identify stakeholders, currently outside the system, which when introduced would act as robust platforms to scale our solution. Some potential partners and their advantages that we could leverage:

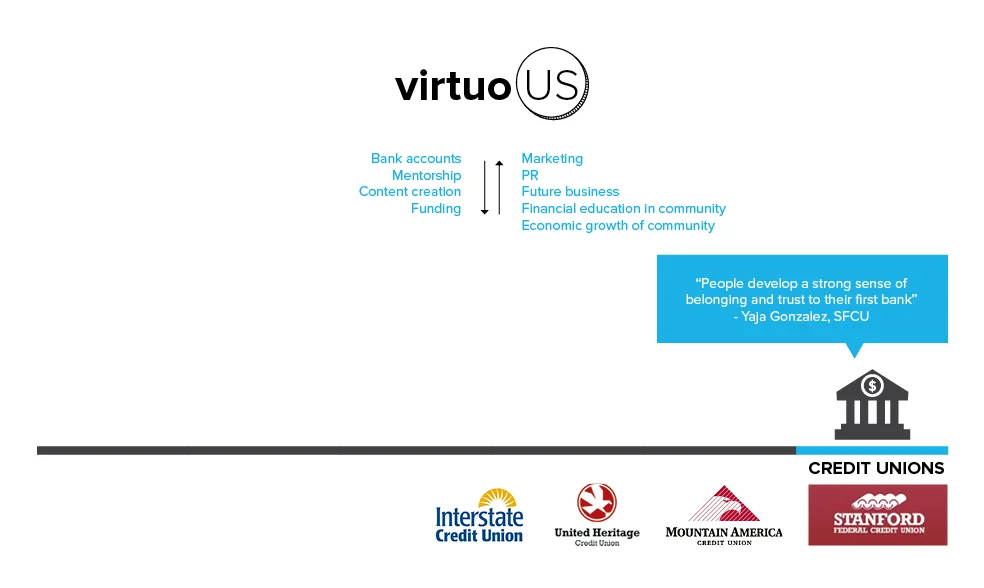

1. Credit Unions

Matching motivations

Already ubiquitous

Mutually beneficial

2. MOOCs

Non-profits like Khan Academy have a scaled platform

They are experts at building content that is engaging

Financial literacy will help them expand to “life skills”

3. Merchants

ALL merchants lose >2% of total REVENUE when customers pay using credit cards

They are largely unsuccessful in getting customers to pay cash

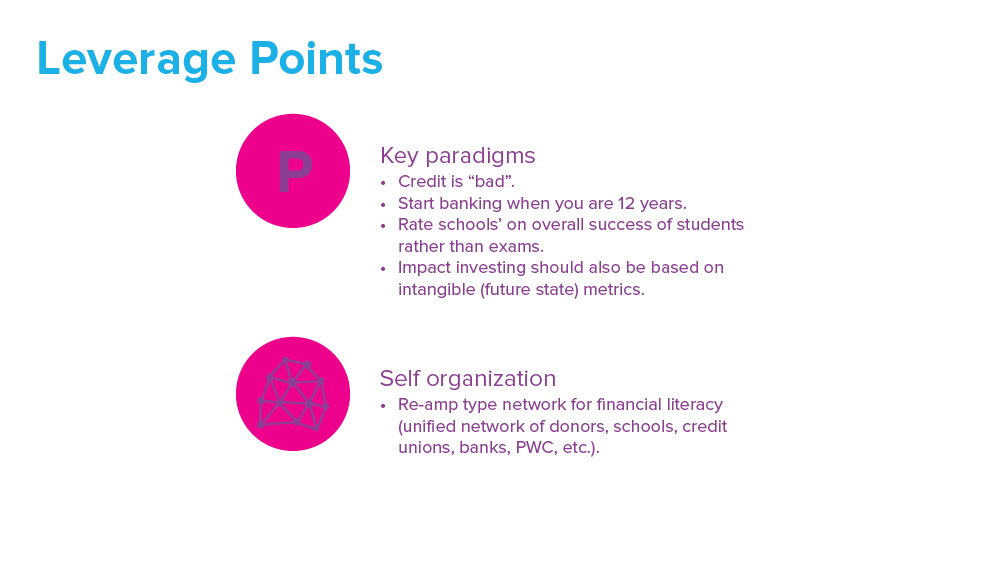

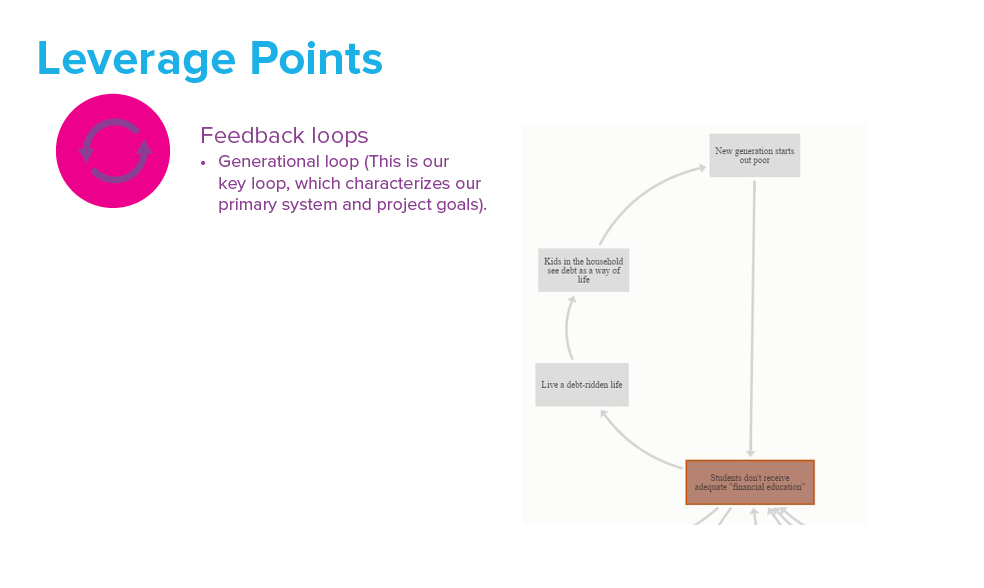

Leverage Points

__

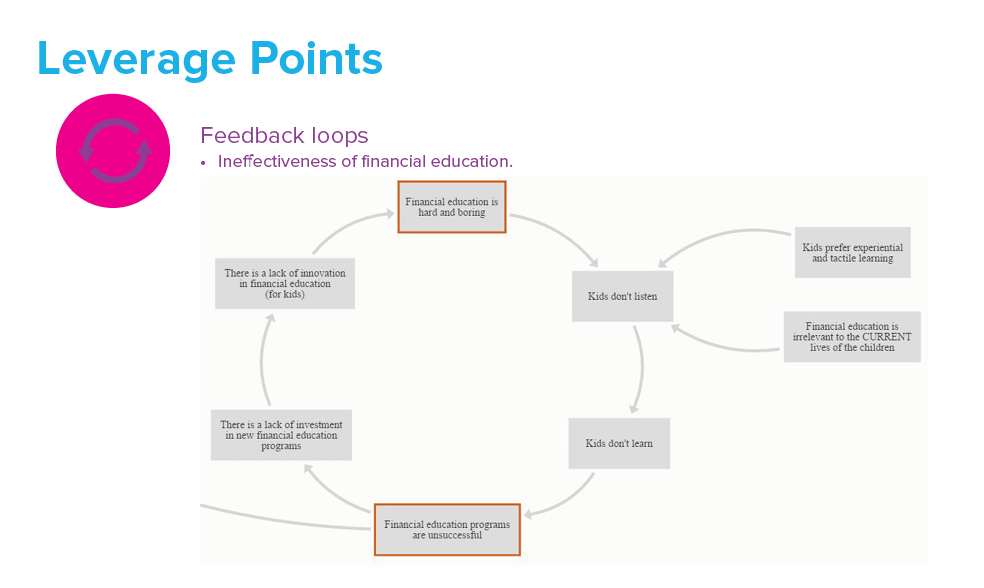

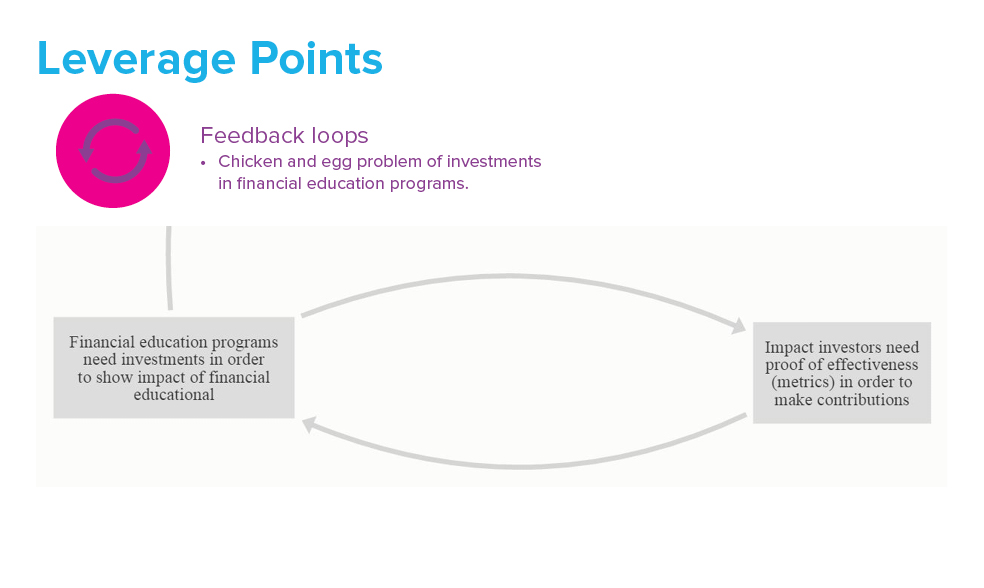

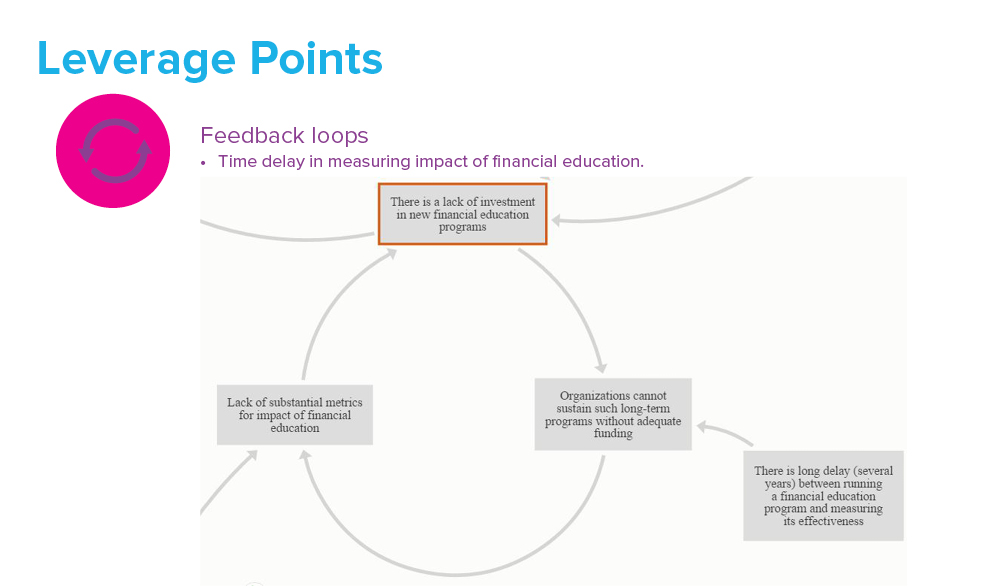

Based on Donella Meadow's study, we identified leverage points, where a small shift in one thing can produce big changes in the overall system.

Early Theory Of Change

__

Based on all the information and frameworks we had until now we came up with our early theory of change:

If an effort is made to prove the value of financial education (create believable metrics) using new teaching methods (that solve the problems of relevancy and tactility) and involve stakeholders like financial institutions, educational institutions, governmental institutions, impact investment institutions, etc., then the next generation of intervention and education programs will become scalable.

Instead of solving the problem of financial education at scale, solve the problems that are preventing the scaling of financial education:

Investment

Buy-in

Effective teaching methodology

Point Of View

__

How might we create financial empowerment for economically challenged middle and high school children living in urban America, through a kinaesthetic experience that helps them visualise their financial future?

Solution: VirtuoUS

__

After building multiple prototypes, testing them with our various stakeholders and refining them, we designed an online platform VirtuoUS where students work in teams to guide their game character through different challenges, making decisions that have financial impact on their characters’ life. This approach was designed to:

Create a fun and engaging way to teach financial literacy to children.

Help students experience the importance of making good financial decisions, despite being in a stage of life where they make little or no financial decisions of their own.

Deploy at a very large scale across geographic regions, removing the need for creating and delivering content multiple times.

Include members of the larger community to volunteer their time and motivate and guide the children.

Provide a “matching service” between NGOs that deliver the proposed solution to schools, and impact investors or philanthropists funding these NGOs.

The short film below showcases the solution along with every stakeholders story, their relationship with each other and VirtuoUS.

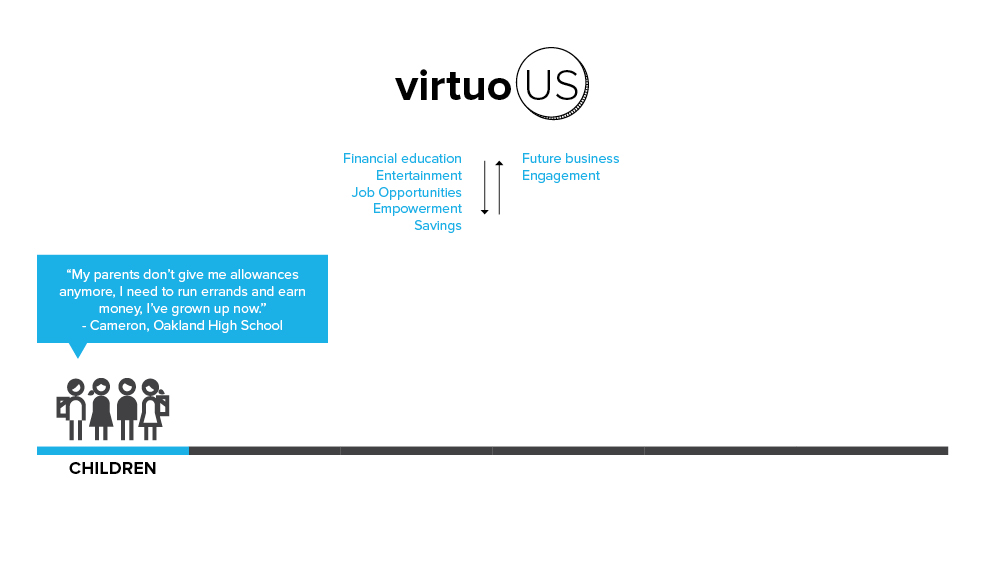

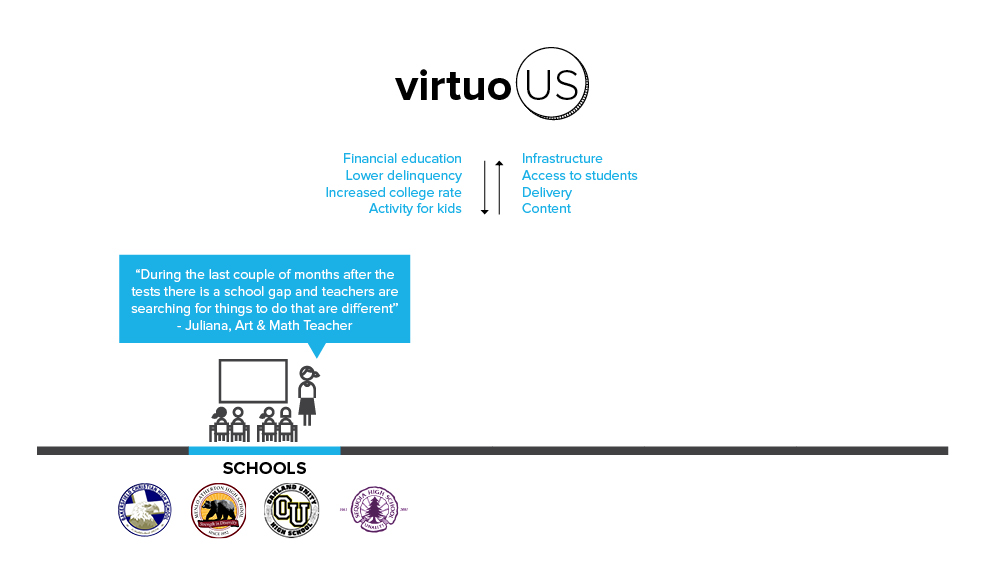

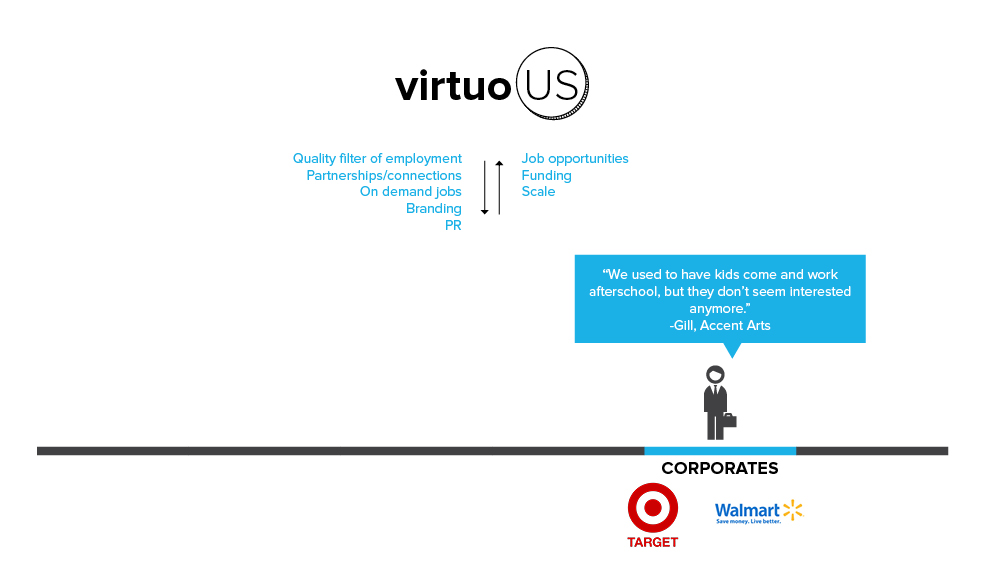

The following diagrams show different stakeholder relationships with VirtuoUS.